The vast adoption of high-deductible health plans means consumers are financially responsible for a greater portion of their medical costs. Yet, our current revenue cycle was designed around commercial and payer reimbursement, not patient payments. Today, collecting patient payments has become a challenge for many provider organizations and creates significant financial stress for both the patient and the provider. The first step in collecting is identifying a patient’s coverage and determining the final amount they will owe.

The underlying problem spans data silos, lack of interoperability, and data latency between provider and payer systems. These challenges create extensive lags in getting updated information on multiple coverages or changes in coverage status. Consider that consumers change their health plans numerous times throughout their lives. Since most benefits must be renewed each year, even if consumers don’t change carriers, they can still change their benefits plans.

Often, patients are unsure of their current coverage or whether they have secondary or tertiary coverage. This means providers must manually call insurers or comb their websites to find updated coverage information, sometimes using bots and AI solutions. Even when they find the coverage information, there is no guarantee the information is accurate.

Failure to capture complete, accurate patient coverage prior to service can lead to delays in care and denied claims. In fact, the lack of precise coverage information is the second leading cause of denied claims, leading to increased write-offs, delayed reimbursement, and lost revenue.

In addition to the impact on the provider’s bottom line, the impact on patients is also significant. Patients may end up paying for a service that was covered or receive care they thought was covered only to find out later it was not. When the claim is eventually denied, the patient can end up with an unexpected medical bill at no fault of their own. This can cause distrust and lead to a dissatisfactory patient experience. It may also damage the provider organization’s brand reputation.

What if there were a way for providers and payers to connect to a single network and get real-time access to always-refreshed, accurate, and complete primary, secondary, and tertiary patient coverage information—without the need for a third party? Providers could spend less time chasing information, leaving more time for patient engagement. IT teams would have fewer connections to manage, reducing costs and improving operational efficiencies.

What if denied claims due to timely filing issues or inaccurate coverage or eligibility information were eliminated? Providers would experience fewer write-offs and payer takebacks, a reduction in A/R days, better cash flow, faster and more accurate reimbursement, improved self-pay collections, and reduced denial-related costs.

We no longer have to ask “what if” because the solution is here today. Avaneer Coverage DirectTM, available on the Avaneer Network, enables payers and providers to share information over a single network without building and maintaining separate connections to a myriad of different services, trading partners, and counterparties within the industry. The Avaneer Network becomes a shared source of knowledge.

In the network, payers and providers submit data to their SparkZoneTM, a cloud-based environment, where it becomes discoverable based on permissions set by each participating organization. Users connect to the network via the cloud, where the ID keychain and master index locate the information requested, match it to the data available, and then deliver it to requestors who are permissioned to access it. Data remains in its existing location and under complete control of the data originator.

The Avaneer Network is a secure, permissioned network and platform built on data fabric architecture. Certification, cybersecurity, and compliance are all built into the design. Because data is permissioned at the gate instead of the gateway, it is more secure and less vulnerable to a breach.

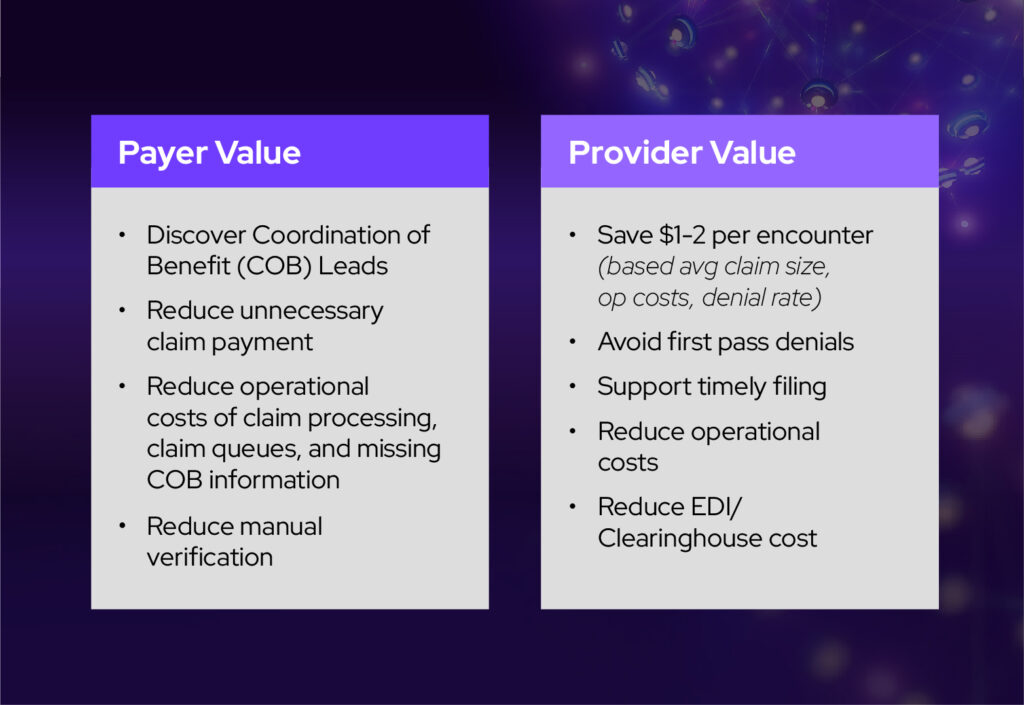

A non-profit academic medical center and a national payer are early adopters of Avaneer Coverage DirectTM and have collaborated on Avaneer Coverage Direct design and outcomes. Early results show that access to more complete coverage information gives insight into data management processes and operational workflows, in addition to the following benefits.

Learn how Avaneer Health can help your organization reduce denials and write-offs, improve collections and reimbursement, enhance the patient experience, and lower administrative costs.