Rachel Schreiber:

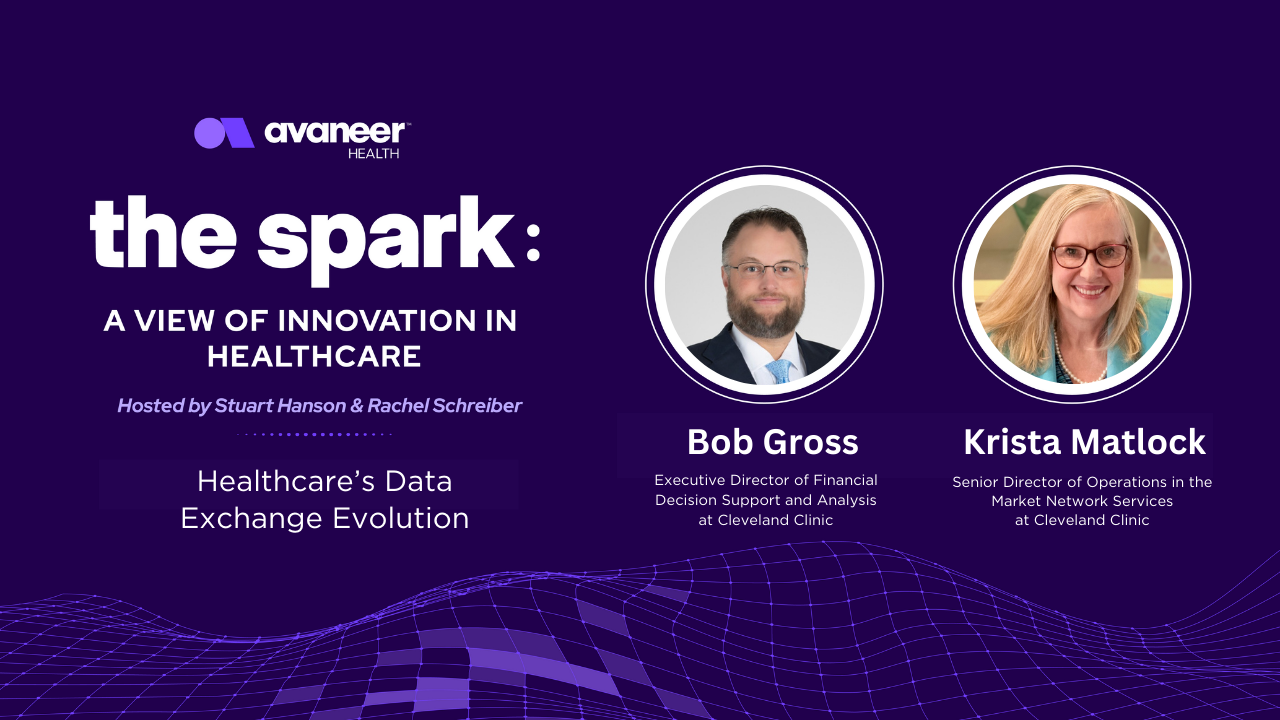

Hello and welcome to the Spark, a view of innovation in healthcare. I'm Rachel Schreiber, your co-host, and in this episode we're speaking with Bob Gross, executive director of financial decision support and analysis at Cleveland Clinic. And Krista Matlock, senior director of operations and market network services at Cleveland Clinic. I'm also joined by Stuart Hanson, CEO of Avaneer Health.

Stuart Hanson:

Thanks a lot, Rachel, and welcome Bob. Welcome Krista. Really excited to have you both on the spark with us. We've been thinking about it and talking about it for quite some time, so I'm really glad to finally have this session put together. I'm really excited to get into our first question, so I'll jump right in. So Krista, I know you've got a really interesting background story in terms of what drives you, what motivates you to tackle the hard challenges in healthcare that we're working on every day? We call that the spark because we know it takes a spark and a really personal motivation to tackle this industry, so difficult to get things done. So I'd love to jump in with you first and ask you the question. Maybe if you could just explain that personal inspiration story that motivates you in healthcare every day.

Krista Matlock:

Sure. I'm going to start out with a couple things and wanted to share that my whole family, my siblings are in healthcare, so we all took a different path. My brother's a molecular biologist. He works on CAR T or did help bring it up. My sister's a nurse and my passion in healthcare is really driven off of making sure that our care providers that are doing the innovative things and the nurses that are at the bedside, that they ultimately can see the fruits of their labor and healthcare. A few years back, and I'm going to date myself now, there was a pole barn that exploded, and this was back when I was working in Michigan. And that pole barn had a lot of tragedies and many patients were med-vaced, airlifted some of them to our hospital and to our burn unit. During that time, it was really difficult to communicate because again, think back 20 plus years ago, we didn't have fully implemented EMRs.

We had partial but not fully implemented EMRs and the insurance companies had the prior office like they do today, and those prior authorization rules required notification within 24 hours of an emergency visit. So as these patients were coming in, we couldn't identify them. They went to the burn unit, immediately, started having skin graft surgeries immediately to stabilize them. And any patient who goes in and out of skin grafts, they're constantly in surgery, you're constantly working on skin grafts. Well, the medical record follows the patient. If the patient's in surgery, you can't do a review and send it back to the insurance company. Ultimately, the health plan denied the care for these members and it was lifesaving care and it resulted in what I call gotcha denials. I'm like, “how do we stop Gotcha denials?” We've got to figure out how to communicate better with patients. How do we communicate or with patients to the plan? So again, I wanted to make sure that we could collaborate with the plans and get them what they needed, but it shouldn't be so difficult where we were getting matching denials. So that's what really drove my future in healthcare, and it drove it in two parts. One was from an interoperability perspective, and two was from a contract perspective working on different contract key terms and conditions.

Stuart Hanson:

I mean, number one, terrible story. Obviously healthcare is riddled with all kinds of really terrible stories and especially in emergent care, but what an amazing and memorable event that must have been, and just a really inspiring, I guess, source of your motivation to try to make things better for the patients. And obviously getting everyone around the table to do the right thing for the patients is a big motivator. That should get us all really excited about what we're tackling. Bob, I know that's a tough story to follow, but we do try to ask all of our participants what their spark is. And I know you've got a really interesting one as well. So do you mind sharing where your motivation comes from?

Bob Gross:

My time in healthcare is relatively mature at this point. I've been at the Cleveland Clinic for just over 16 years. Prior to that, I worked in the financial services industry in both insurance and banking. Having worked at a healthcare provider and being fortunate to work at the Cleveland Clinic where we see patients from all over the world and some of the most complex and severe cases, it highlights for me on a daily basis how impactful the work that we all do across the industry is on the quality of life for our friends, our family, our neighbors. In healthcare, we are a unique industry in that we literally give people the most valuable end result, which is quality of life and health. And we all at some point will be patients. Sometimes we talk about the patient as this abstract concept. The patient is you, it's me, it's our friends, it's our family, and I love being part of the system and an organization that truly takes care of those who I care for. So I would never want to work outside of healthcare.

Stuart Hanson:

Yeah, I agree. I've got a similar passion for it as well, obviously. And I think one of the interesting things, Rachel, I know we talked about this with a couple of our past guests on the spark, but one of the really interesting things about consumerism and the rise of consumerism, right? High deductible plans, a lot of intended consequences of that, which is to get people to really buy into their own wellness, their own health, their own diagnostic procedures, et cetera, but a lot of unintended consequences as well. One of the really positive unintended consequences if you ask me is that getting people more financially participating in their own healthcare decision really does create a shared perspective that we all have where you can't really abstract yourself completely and think about healthcare without the patient because we all experience it. We all experience it more engagingly, if that's a word than we have before. So I really appreciate that, Bob. That's great to share. So let's move on. And Krista, I want to focus a little bit on you. Obviously, we work very closely with the clinic on a number of projects. We've gotten to know you over the past number of months, but I'd love to give you an opportunity to just quickly describe some of the key things you're working on and how you're focused on improving healthcare for the patient and how you focus on that every day and the role that you have at the clinic.

Krista Matlock:

My role in the clinic is in and around operations, and it's the point of operations between payer and provider, and again, that centers around communications, logistics and things like that. And so one of the key things that I'm working on with a lot of the subject matter experts here at the clinic and other folks like yourselves is how do we improve interoperability? Interoperability is foundational, and as you know, we're still using 25-year-old technology that has been put in place. If we go back to the days of HIPAA, it's the old X 12 technology that we think about and you think about real time eligibility. And those transactions that we do today, it's mind numbing to think that we're still using that today because things have evolved and other industries have evolved and moved away from that so that we can communicate more clearly on behalf of the patients with the insurance companies. And again, if you think about it, we should be working collaboratively together to make it easier for the patients and members that we serve.

Stuart Hanson:

Yeah. Bob, anything you'd like to add to that?

Bob Gross:

Very similar perspective, and we will get into this later. When we think about other consumer experiences that we all engage in, healthcare is still the most painful and disjointed experience that any of us who have any member liability associated with our insurance plans experience every time you see a provider, and at times we view it as a necessary evil in the process, and there are certainly perspectives around all the stakeholders within our industry to support why we need the protocols and processes that are in place. But I ultimately find it to be very disrespectful to patients that we do expect that our patients are financially engaged in their care. We expect that they're incentivized and rewarded when they make healthy decisions, and yet the systems that we have in place to help facilitate and adjudicate that process aren't up to par. And we leave our patients frustrated and not knowing what they really owe out of pocket until long after care has been rendered. And that simply doesn't exist in any other consumer oriented industry.

Stuart Hanson:

Yeah, it still persists, right? I think, Krista, you talked about the days of HIPAA. Gosh, it was last century that that legislation was passed, and one of the big things that resulted from that, I used to be able to quote the sections of HIPAA, I've lost my recollection of that, but administrative simplification was one of the great goals of HIPAA, which tried to move the healthcare industry to electronic communications and was the foundation for a lot of things that have followed around EHR subsidies, et cetera. But one of the unintended consequences, and you talked about logistics of healthcare, was the adoption of a really old antiquated communication protocol, which is X 12 EDI, which God bless the work groups that have made that work right in healthcare for the last 25 years. But the reality is that was created for the steel, the auto industry, for logistics tracking, for identifying where a rail car was with steel bars on it to come into a production center or a service center in the automotive industry.

And those industries, to your point, Bob, have really moved on from a lot of that latent batch based electronic communications because there's better ways to do it . And unintentionally healthcare, because the data is so complicated and the relationships and the stakeholders are so numerous and intertwined, it's been difficult to move to something more modern. And we talk about all the new fire standards and all the great initiatives underway now, but it's hard to unwind that in an industry that's this complex or to even adapt it to be more real time and more conscious of the impact on the patients. So obviously that's a huge, huge challenge that we've all worked with over the last number of 20 or so years in healthcare. Maybe aside from that, Bob, what would be one of the, or a few of the really big challenges that you're dealing with today, and how do you really introduce innovation that overcomes the kinetic energy or the momentum of the status quo and the technology that sometimes that comes with that?

Bob Gross:

So when I think of the challenges that we face in transforming this part of our industry, the interoperability side of our industry, technology is available at this point to radically transform most of these events within our patients' workflow where we can be much more elegant. So I actually don't see it as much of a technology problem. There are certainly best practices and approaches that are better than others, but I see more of a challenge around the operating model and the incentives around collaborating to make these improvements. When we think of the major stakeholders within our industry, the United States is relatively unique in the regard that many of us obtain our health insurance coverage through our employer. There aren't nearly as many individuals who are buying insurance on their own, on the health insurance exchange. And when we all get to a certain age, we move on to government programs.

So largely the products that we're being offered as patients are largely determined for us by our employer. So incentivizing employers to participate in the transformation and incentivizing payers to participate in the transformation so that we can all achieve more optimal outcomes, less administrative burden, less administrative expense, while maintaining utilization management and medical loss ratios is a very difficult balancing act. Again, I recognize that something like the prior authorization process, I don't think anyone likes that process. I think we can all agree that the reasons for that process existing are valid. We have to manage medical spend, we have to make sure that providers are performing services that are medically necessary, and that employers oftentimes who are on the hook for paying for those services have an opportunity to review and make sure that that's approved as part of their policy. But again, we have to do it more elegantly. But again, I see the bigger challenge in rallying all those stakeholders together to solve the problem once we get all the stakeholders united and aligned on the why and the benefit, the technology now exists to actually make this a reality.

Stuart Hanson:

Yeah, agreed. Krista, you want to add anything to that?

Krista Matlock:

Sure. I would just caveat and say that with respect to authorizations, obviously you look at it and you look at how many are approved, and when you start breaking down the data points, it is apparent that over 95% of authorizations are approved. So you start beginning to ask yourself, why do we have all this labor intensive process on so many different services? And so a number of organizations throughout the country have been working to meet with the insurance companies and talk about how can we eliminate some of this administrative burden and how can we still give you what you need? And so those are the things that we're beginning to tackle and seeing some success. And again, we're trying to gain some synergies and gain it with enough health plans so that we can really figure out how can we make the technology work in a more simplified manner, get the insurance companies what they need in order to authorize the care and monitor the medical care without being overburdensome. And oftentimes authorizations because of the lag time in communicating, they delay patient care. And that's not good for anyone. I mean, it's not good for the patients, the physicians who have to get on the phone with the medical directors from the insurance companies. Again, we don't want to do that. We want to figure out how can we communicate effectively, get them what they need and get the care delivered really timely.

Stuart Hanson:

Yeah, I think there's been so much discussion around prior auths, and I think it'd be really interesting to apply a pure economic study to how much cost goes into those a hundred percent to potentially save 5% of the transactions that ultimately don't get approved that maybe weren't necessary. Or there's a care coordinator trying to do a really great job making sure it's the best possible care or to eliminate fraud or whatever the other downstream benefits are of that process. I think obviously there's a lot of discussion around value-based care being the big motivator to really align incentives more tightly because I've had a number of discussions in the industry around prior auth, and I don't think anybody believes that a care coordinator or someone who maybe asks for more information is trying to do a bad job or is trying to erode or cost the patients the care that they need.

Everyone's trying to do the right thing, but they have the wrong incentives in a lot of cases. And I think value-based care is hopefully going to help from that perspective. Maybe it makes sense for us to just have a quick discussion. And Kris, I don't know if this is better for you or for Bob, but I'll toss it to you first. Based on all of the collaborative work that you're in the middle of with different payers across the country as well as different stakeholders within the clinic, what do you think is the most tying of those opportunities to value-based care and the overall incentive alignment that could create for the industry? Sorry, I know that's a loaded complicated question. That's

Krista Matlock:

A loaded complicated question. Yes, I think there's a couple things. Obviously in value-based care, we can align incentives and we become part of the same team with the health plans. Now, we've tried a number of different models, and I've tried a number of different models throughout my career, but really when you begin working the most collaboratively together is when you're in a downside risk model. So we are looking to really expand upon that going into the future, and as we go about doing that, we have to be on the same team with the health plans, and we have to be very clear as to what they're going to do and what we're going to do and how we're going to do it together and collaborate together. So that opens the doors for joint processes, it opens the doors for better communication, and I think the technology can really enable us to perform better and have better outcomes as we continue to work on driving better pop health across our systems.

Stuart Hanson:

Yeah, I agree. Bob, I know that links really tightly with a lot of the stuff you and I have talked about before too. Go ahead.

Bob Gross:

Yeah, I would say the downside right now to value-based care is that it is the least mature interoperability framework within healthcare. So I know we begrudge some of the limitations of the X 12 EDI standards. There are very few standards that exist within the value-based care arena. Now, that being said, it also provides us with a tremendous opportunity to leapfrog some of the traditional problems that plague us on the fee for service side of our industry and really become creative and innovative, not only in the way that we share and exchange medical record data between organizations, but the way that we manage enrollment, the way that we manage quality score reporting, the way that we manage care coordination. Those are all imperatives to make a value-based care arrangement work. At the end of the day, the value in value-based care is providing patients with more comprehensive healthcare where we're helping to manage their comorbidities and their chronic conditions. The only way that we can successfully do that is if, as Krista mentioned, we operate as a singular organization. We have to remove as many barriers between the health plans and the healthcare providers as possible. And again, the beautiful thing is that the technology is here, the fire standards, which are part of HL seven, they're here, the technology to exchange the data, it's here today. It's a matter of organizing and executing on those specific data requirements,

Stuart Hanson:

And it challenges a lot of the infrastructure that's been used while that wasn't here and that evolved while that wasn't here. So I agree that's a big challenge. Rachel, I know you wanted to ask a few questions as well. Sorry, I'm hogging all the air time here.

Rachel Schreiber:

Yeah. So I was curious as far as when you're looking at other industries and creating that patient experience, what other industries do you think healthcare could learn from? And Krista, do you want to start?

Krista Matlock:

Sure. I think going back in time, everybody looks to the banking industry. Think about when we used to write checks all the time or carry cash with us, and now everyone carries a card or you have Apple Pay. I mean, it has totally transformed our lives. And you take that one step further, even if you look at what we can do to buy goods and services and Amazon, but Amazon's a logistics company in many respects because they're shipping goods and services to you very simplistically. So I think if we take a step and look at some of the industries that have done it and done it well, banking is very accurate. I mean, it is extremely accurate. So when I think about our industry today, just the information that we get that comes from the employer groups, the employer groups feed the insurance companies on who is their member, well, that data is often lagged by 60, 80 or 60, 120 days because of whatever contract that the employer group signed with the insurance company. So somehow we've got to get better information in the hands of all of us, and we have the technology to do it. We just need to roll up our seats and do it.

Stuart Hanson:

Yeah, you can't use an ATM card after you close your bank account, right? It's a good example. The data is just there and it's visible and available.

Bob Gross:

Yeah, I would offer banking has, and financial services have demonstrated the elegance in having automated clearing houses and unified transactions across the industry. There are examples within the insurance industry that we could learn from in the health insurance space. If you look at property and casualty insurance, especially in automotive insurance, that's a very technologically advanced industry. If you're ever unfortunate and you get in a car accident and you need your car repaired, insurance companies are very well connected with certified repair shops and even independent repair shops to be able to very quickly estimate damages, generate claims, loss adjustments, and within a matter of one to two business days, you as the owner of that car will know what your out of pocket is going to be, what repairs are required, and the automotive shops will know largely what they should expect to be reimbursed from insurance.

It's a system that works. Cars are not as complex as humans, but I would argue they're relatively complex machines dealing with multiple types of mechanical systems, electrical fuel, that there are literally tens of thousands of makes and models of automobiles on the road. And not often would you find yourself in a situation where an auto repair center would not be able to work on your car or you wouldn't be able to find anyone that could work on it to repair it. Another example, and again this is a little more referenced example, is the travel industry, not necessarily just airlines, but hotels, any type of transportation when it comes to ride share or even mass transit, those are all very well integrated networks where when you get on an airplane, you largely do that from your phone. Now you still do have an option to get a printed boarding pass.

It's usually a fight with the airline that you're on, whether or not you can get one. But everyone's got their phones with them now everyone knows that I have to have my boarding pass on my phone. When you go through TSA, everything is designed for your smartphone to fit in to be scanned. So those industries, they've advanced themselves, they've identified those pain points related to the consumer and they've solved for it. Again, largely because there was alignment of incentives. The dental industry is actually a really great use case that I would love to reference more often in healthcare. Oftentimes, patient out of pocket is known well in advance of any type of dental procedures or orthodontia, and it's acknowledged upfront by provider and patients that, Hey, there's going to be an out of pocket here related to these services. And it's much more transparent. It's much more, you may not like the answer that you owe a certain amount out of pocket, but you at least know that before work begins. So I would love to learn more from those industries and those examples and bring that into healthcare.

Rachel Schreiber:

Yeah, it would seem that, especially with the dental, that's a great, a lot of medical procedures are that simple. Some aren't. I know that you are organization, you have very complex, but most of us are receiving pretty straightforward care.

Bob Gross:

Yeah, yeah, I would agree. Even in the most complex of clinical settings, there are a large number of routine medical procedures and visits being performed that do not require an overly complex review process in order to estimate what a patient or a member owes out of pocket in order to provide them with financing options to be able to pay for that. Again, I find it disrespectful to patients that we can't do that elegantly today. You're already, as a patient in a stressful situation. I can't think of any time I myself have been a patient where I was particularly happy about the fact that I was at the hospital. You're already likely under a lot of emotional stress, a lot of personal stress, and then on top of it, we're creating financial ambiguity for you to have to worry about. I just find it to be disrespectful at the end of the day.

Rachel Schreiber:

Those are good points. So then as a wrap up, can you summarize the vision of what you've created this vision for what you're creating in healthcare? What's that ultimate experience? I think let's start with Krista, because I think for Bob it is that patients know what to expect from a financial perspective. Is there anything you'd add to that, Bob?

Bob Gross:

I would just say like all other mature consumer-based transactions, we should treat our patients with the same respect and dignity that they receive elsewhere. You go to the bank, you go to the grocery store, you get on an airplane, you're not worried the whole time about the ambiguity around what you may owe, about what surprise may come around the corner, what gotcha is going to come out of the woodwork. We need to be better about accurately estimating and presenting patients what their benefits cover. And again, whether a patient or a member knows that information ahead of time or not. That's something that we cannot control, but what we can control is being transparent and comprehensive with our patients in having a financial discussion that's respectful to them. So being able to estimate upfront with an insurance company in tandem at the table with us being able to collect from a patient and a member their out of pocket amounts, and to provide them with certainty that that number is not likely to change. Your insurance provider and your healthcare provider are coordinating their activity. We're approaching you together. It's not a disjointed effort and making it as timely as possible. We can't wait sixty, ninety, a hundred and twenty days to put a statement in your online portal or in your mailbox, and then have you find out that, oh, I did actually owe a thousand dollars on this. We have to be quick about that. Within one to two weeks, we should know what you owed and we should be able to have that conversation with you. That's my vision around consumerism and insurance and healthcare.

Rachel Schreiber:

And Krista, what would you add?

Krista Matlock:

I would say it's like this. I think what we're really trying to do is create a harmonious member-centric experience to improve health and then also to reduce payer provider friction. And I think if we're doing that really well, we're all healthy, the patients are healthier,

Finances of healthcare are better because we're not wasting, there's a lot of waste. As I look across the industry, there is so much waste and somehow we've got to get more efficient to reduce the waste. The insurance companies can make their money, the providers can make some money too. And again, we can be financially healthy together and we can do this in a way that improves the health both financially for the patients because we've seen patients that get bills after the fact and we want to make sure that we can have those conversations upfront so that they're planning accordingly.

Stuart Hanson:

Right. And the good news is, I think you both alluded to some really positive takeaways. Sorry, Rachel, just before we wrap up, I want to hit on a couple of the things that I heard that are inspiring. Going back to where we started. The good thing is the technology is there, right? The data is available. All these systems on the backend have been upgraded or are being upgraded, and the parties are at the table to collaborate to try to solve this because with $4 trillion in our healthcare system and a trillion of that being spent on administration, no one can argue there's not a lot of waste. And addressing that waste should provide an opportunity for everyone to do that in a financially beneficial way for their organizations. Even though the incentives aren't always perfectly aligned, there is, I think a central thesis of everyone wanting to do the greater good, if you will, on the healthcare spectrum.

Rachel Schreiber:

That's exactly right. So today, to wrap up, thank you for joining us today and sharing your perspective on healthcare innovation. If our listeners would like to keep up with what you're working on, you can follow Bob Gross and Krista Matlock on LinkedIn. Thank you.

Bob Gross, Executive Director of Financial Decision Support and Analysis at Cleveland Clinic, and Krista Matlock, Senior Director of Operations and Market Network Services at Cleveland Clinic, discuss what puts the value in value-based care and how close we are to success. “The beautiful thing is that the technology, FHIR standards, and the data are here today.” Stakeholders are now coming to the table to discuss ways to create mutually aligned incentives that alleviate friction, reduce risk, and create a harmonious member-centric experience. “We are in a unique industry in that we literally give people the most valuable end result, which is quality of life and health.”

Bob is an enthusiastic finance leader who is energized by serving, developing, and growing those whom he supports. He truly enjoys the challenge of learning and implementing new and emerging technologies in meaningful and impactful ways.

Bob serves as the Executive Director of Financial Analytics at The Cleveland Clinic. He has over 15 years of progressive leadership experience in healthcare, having led teams that deliver solutions by leveraging robotic process automation (RPA), data science, data warehousing, data visualization, and advanced interoperability. He has held prior roles in financial planning and budgeting, enterprise analytics, and revenue cycle management.

Bob also serves as a thought leader and advisor of technology adoption and innovation within the Cleveland Clinic and the healthcare industry.

Krista joined Cleveland Clinic in 2018 as the Director of Business Development and Payer Contracting. She has worked for over the past 25 years in the healthcare industry with management and leadership roles in both payer and provider organizations in Michigan, Kentucky, Indiana, and Ohio, including Spectrum Health, Kent Health Plan, and Catholic Health Initiatives. She also served as an officer in the United States Army/Army Reserves for 14 years.

Krista holds a Bachelor’s degree from the University of Illinois and a Master’s in business administration from Eastern Illinois University. In her new role as Senior Director, Operations Market, and Network Services, she is responsible for credentialing and payer operations.